Understanding IRAs is an important step for your future. This Financial Literacy for Artists article breaks down three types and how to choose the right one for your situation.

In Southwest Contemporary’s Financial Literacy for Artists series, we bring you financial content that can apply to artists working in any medium and at any career stage.

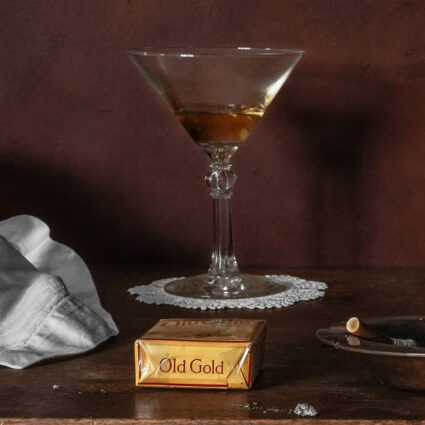

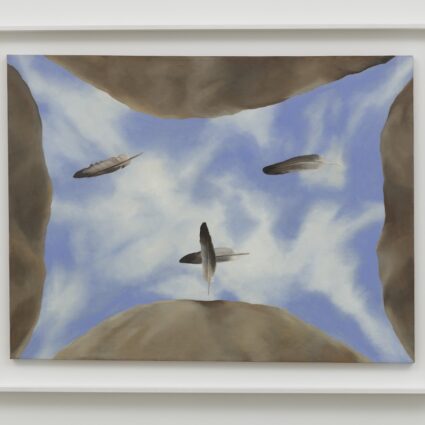

Over the past three years, Tamara Bates, founder of the fellowship the dots between, has worked with hundreds of artists in the Southwest and across the country. Her articles share information on the core topics she has been asked about and what she learned as a financial advisor. The images in this series are all from previous dots between fellows.

This is the eighth article in a series exploring financial topics pertinent to artists at different career stages. The columns in this series include:

- What You Need to Know as an Emerging Artist

- What Mid-Career Artists Need to Plan For

- What Late-Career Artists Need to Consider

- Basics of Managing Uneven Income

- Protective Factors for Managing Uneven Income

- Aligning Revenue, Time, and Values

- Student Loan Updates

- IRAs Explained

- 401(k) and 403(b) Employer Retirement Plans

- Sandwich Generation Financial Planning and Family Needs

Individual Retirement Accounts (IRAs) Explained

Understanding how IRAs work is an important step to saving and investing in your future. IRAs, an important vehicle to support yourself in older age, can save you money on taxes and allow your money to grow tax-deferred.

We’re going to look at three types of IRAs that are most likely to apply if you’re self-employed or work for an employer that does not have a 401(k), 403(b), or other types of retirement plans.

Please note: the IRA is the container, not the investment. I see a lot of confusion with people thinking the IRA is the actual investment. The IRA is like a basket you fill with groceries—in this case, the groceries are stocks, bonds, and other kinds of investments. Today we are going to look at what type of basket is the best choice for your situation.

Beginning to Invest

When you are just starting to invest for the future, a regular IRA or a Roth IRA are probably the most appropriate choices.

Let’s look at what regular IRAs and Roth IRAs share:

- Both of these will grow tax-deferred and allow your contributions to grow tax-free (you don’t pay taxes on capital gains, dividends, or interest).

- They have the same 2023 contribution limits: $6,500 (or $7,500 if you are age fifty or older).

- For any given tax year, you have until the following April to make contributions. For tax year 2023, you have until April 15, 2024.

The differences between regular IRAs and Roth IRAs:

- The major difference is that the regular IRA will reduce your taxable income in the year you contribute. This benefit comes with a downside—if you pull out money before age fifty-nine-and-a-half, you will be charged a 10 percent penalty. You also have to pay income tax on money taken out of an IRA at any time.

- While it’s nice to pay fewer taxes, if you are in your twenties and thirties, I’m going to suggest a Roth as a good starting place in case you need to access these funds early. Because the Roth does not reduce your taxable income, it’s considered after-tax income by the IRS. And because it’s considered after-tax income, there’s greater flexibility in the rules that govern Roth IRAs. Read this article for a full rundown.

- It’s best not to tap your “future you” money early, but I know how life is and that’s why the younger you are, the more likely it might be that you need to access these funds. Think through possible scenarios as you make the decision on which IRA vehicle to select.

- When you pull money out of a Roth after it has been invested for over five years, it’s not taxed whereas the regular IRA will always be taxed as income in your tax bracket.

Can I Have Both??

Yes, you can have a regular and Roth IRA, too, but you cannot contribute to each in the same year. Some people pick one over the other depending on their tax situation in a given year. When folks need to reduce their taxes, they choose the regular IRA. When they have less income, they contribute to the Roth.

This seems like a sound strategy on paper, but I caution against having too many small buckets of money—it will be harder to accumulate in the long run. Because of compound interest, one larger investment bucket will grow faster than a small one.

I advise people to pick the one basket/type of IRA that’s going to work for them over the long term and stick with that choice for the majority of their contributions.

Options for Higher Earners: Simplified Employee Pension Individual Retirement Accounts (SEP-IRA)

If you would like to invest more than the maximum IRA rate of $6,500 (or $7,500 over age fifty), you may want to set up a SEP-IRA, which allows you to contribute roughly 20 percent of your profits as a self-employed individual. For example, if you make $100,000 and have $20,000 in expenses, you can contribute up to $16,000 (20 percent of $80,000 net income).

Your SEP contributions are the biggest tax deduction available to the self-employed. Like a regular and Roth IRA, you can open and contribute to a SEP-IRA until the tax filing deadline the following year.

This is a good option if you are a solopreneur. If you have full-time employees, you will have to make the same SEP contribution on their behalf that you do for yourself, making it an expensive option.

You Can Have Both!

Another great option with a SEP-IRA is that you can also make Roth contributions in the same year. This option maximizes your flexibility to invest in a tax-deferred manner that takes advantage of the tax-free benefits of the Roth.

In the example above, you could contribute $16,000 in your SEP and $4,000 in your Roth (you can invest up to $6,500 but you don’t have to contribute the full amount) or $10,000 in your SEP and $6,000 in your Roth. However, you would want to parse out the contributions that make the most sense for your situation.

I show these examples to help you realize that the maximum contribution you can make does not equal the amount you have to make—you get to pick what works for you. You just cannot exceed the maximum amount.

Conclusion

Starting early with an individual retirement account is the most important thing you can do to make sure that seventy-, eighty-, and ninety-year-old you has enough income to live on. Starting small is better than not starting at all. And as long as you are still working, you can begin. Opening an IRA in your sixties can still be helpful if you plan to work another seven to ten years.

In the next article, we will look at employer plans like 401(k)s and 403(b)s. In the meantime, feel free to reach out to editor@southwestcontemporary.com if you have any financial questions.