In Southwest Contemporary’s Financial Literacy for Artists series, we bring you financial content that can apply to artists working in any medium and at any career stage.

Over the past three years, Tamara Bates, founder of the fellowship the dots between, has worked with hundreds of artists in the Southwest and across the country. Her articles share information on the core topics she has been asked about and what she learned as a financial advisor. The images in this series are all from previous dots between fellows.

This is the sixth article in a series exploring financial topics pertinent to artists at different career stages. The columns in this series include:

- What You Need to Know as an Emerging Artist

- What Mid-Career Artists Need to Plan For

- What Late-Career Artists Need to Consider

- Basics of Managing Uneven Income

- Protective Factors for Managing Uneven Income

- Aligning Revenue, Time, and Values

- Student Loan Updates

- IRAs Explained

- 401(k) and 403(b) Employer Retirement Plans

- Sandwich Generation Financial Planning and Family Needs

Aligning Revenue, Time, and Values

In the last few articles, we talked through strategies for our income. Now we are going to look more deeply at how we are allocating our time. Hopefully, what provides us income and what we spend our days doing also aligns with what brings us joy and meaning.

We are going to pause within the hustle, analyze our revenue and networks, and examine how we can move towards a life where our highest income-generating activities are also generative for our hearts and minds.

I’ve witnessed many artists complete these exercises and end up in a completely different place a year or two later, where they are well-paid for the work that is most meaningful to them.

Unless we analyze these factors and make some goals, it can be difficult to line up how we earn money, how we spend our time, and if we are mainly engaging in activities that match our values.

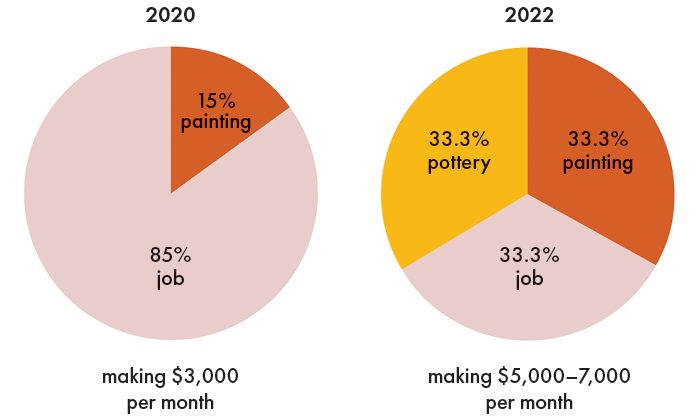

A Simple Pie Chart Exercise

This is an exercise I give the participants in the dots between:

- Make a pie chart of your current revenue streams.

- At the bottom, write the total amount you are bringing in.

Ask yourself:

1) Is this enough money?

2) Am I spending my time the way I want to?

If not, draw a pie chart of your ideal revenue sources and plan your time according to how you will meet the growth of each stream. You can decide to focus on different times of the month or year or by inspiration. You may have several iterations before you meet the ideal. Here’s a quick time-management tool to help you facilitate this plan.

Here’s an example of someone who was able to change how they earned money and spent time to better match their goals:

Once you understand your revenue streams and the percentage of your budget that these income sources meet, plan how you want to spend your time to increase or decrease activities based on inspiration and the reality of what you need to make.

Investing Time in Your Community

Another item to consider when growing your resources and projects is to invest time in the people and places that represent your ideal for your practice. Here’s another handy exercise:

- Create a map of your relationships beginning with those closest to you who know your work well.

- Draw another circle of acquaintances and where they work.

- Finally, make an outer ring with your dream people and institutions. What places and people would you most like to be engaged with? Can your inner circles connect to the outer rings?

Keep an email list, track your network, and communicate regularly with your resources. Also, craft a plan for keeping in touch in a way that feels genuine and sincere.

Conclusion

Aligning your money, time, and values is a process. Don’t be too hard on yourself if you haven’t figured it out yet.

Your plan will likely evolve. What may have been a good and fulfilling income stream at one point can change. We continually need to adjust these dimensions to create a sustainable and fulfilling practice over the long term.

Good luck!

If you have a financial question or topic you would like to see addressed, drop us a line at editor@southwestcontemporary.com.

Disclaimer: This information is for educational purposes only and should not be construed as official financial, legal, or tax advice. Please seek specific advice for your situation from authorized individuals.