Though widespread student loan forgiveness isn’t happening, there are still important changes afoot. Here’s some breaking news, tips, and things to know before loan payments resume in fall 2023.

In Southwest Contemporary’s Financial Literacy for Artists series, we bring you financial content that can apply to artists working in any medium and at any career stage.

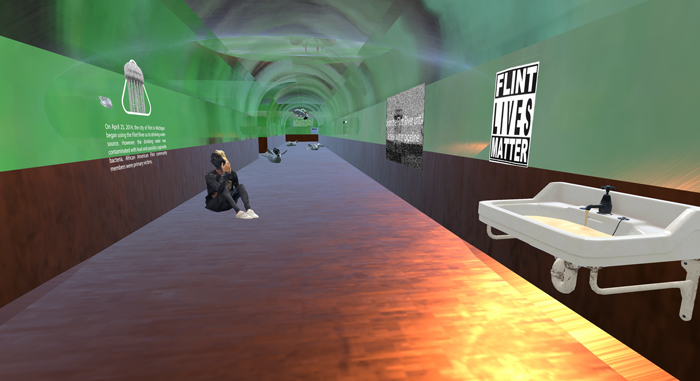

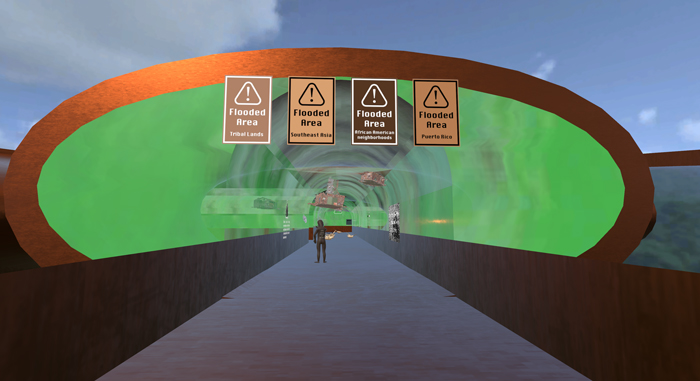

Over the past three years, Tamara Bates, founder of the fellowship the dots between, has worked with hundreds of artists in the Southwest and across the country. Her articles share information on the core topics she has been asked about and what she learned as a financial advisor. The images in this series are all from previous dots between fellows.

This is the seventh article in a series exploring financial topics pertinent to artists at different career stages. The columns in this series include:

- What You Need to Know as an Emerging Artist

- What Mid-Career Artists Need to Plan For

- What Late-Career Artists Need to Consider

- Basics of Managing Uneven Income

- Protective Factors for Managing Uneven Income

- Aligning Revenue, Time, and Values

- Student Loan Updates

- IRAs Explained

- 401(k) and 403(b) Employer Retirement Plans

- Sandwich Generation Financial Planning and Family Needs

Student Loan Updates

Even though the United States Supreme Court struck down student loan forgiveness, there are still important changes that may lessen the burden on government loan borrowers. (The below information only applies to government loans, not private ones.)

If you’ve been feeling overwhelmed—and disheartened by student-loan debt—you’re not alone. The system was not working. However, there are some positive actions underway to correct past wrongs and I hope they will benefit you.

This information is quickly evolving and in flux. Here’s some breaking news, tips, and things to know before loan payments resume this fall.

Public Service Loan Forgiveness

If you’re employed by a government or not-for-profit organization, you might be eligible for PSLF. The program forgives the remaining balance on your direct loans after you’ve made the equivalent of 120 qualifying monthly payments under an accepted repayment plan and while working for an eligible employer. Some good news on this front: the last three years that payments have been paused count toward these 120 months!

There were some important changes to make this program work better. You needed to apply before October 31, 2022, to have these impact you. If you did apply, you may see your loan forgiveness soon—one of my dots between fellows just had over $100,000 forgiven last month.

If you didn’t apply for the time-limited changes but work in public service, you can still apply for forgiveness. Start by checking on your eligibility or creating an account following these instructions.

If you don’t have one job at thirty hours a week, you can combine different jobs at eligible institutions to get to the average thirty hours and still qualify. It’s worth it to try now if you think you have close to these hours and employers who will verify your employment.

Income-Based Repayment Changes: REPAYE to SAVE

The U.S. Department of Education recently approved changes to its existing income-driven repayment plans, known as REPAYE, in which borrowers’ monthly payments are tied to their income and family size. The new program Saving on a Valuable Education, also called SAVE, will enable millions of borrowers to cut their monthly federal payments by more than half. The new repayment plan would become a permanent fixture of the student loan infrastructure and apply to current and future borrowers.

If you were or are on an income-based repayment plan, you won’t have to apply to be part of these changes. It will happen automatically. The plan reduces payments on undergraduate loans to 5 percent of a borrower’s income, down from the 10 percent charged under previous income-driven plans.

One of the most profound changes to this program is that borrowers will no longer see their loans grow due to unpaid interest. The Department of Education will stop charging monthly interest not covered by the borrower’s payment.

Timing: it’s expected to roll out in July 2024.

Other Resources

Loan Simulator helps you calculate student loan payments and choose a loan repayment option that best meets your needs and goals. You can also use the tool to decide whether to consolidate your student loans.

You may want help from a student loan professional. I haven’t had personal experience with these professionals, but the CSLA Institute website was mentioned in a New York Times article as a good resource. These individuals are trained in different student loan repayment options and have gone through a vetting process.

You can also check out the Federal Student Aid site for all the various scenarios that may apply to your situation.