In the final article in Southwest Contemporary’s Financial Literacy for Artists series, Tamara Bates discusses how artists can stay on track with their nest egg while simultaneously supporting family members.

In Southwest Contemporary’s Financial Literacy for Artists series, we bring you financial content that can apply to artists working in any medium and at any career stage.

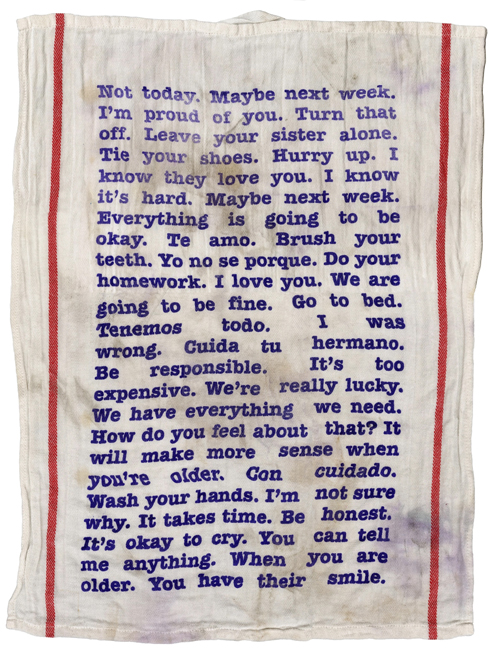

Over the past three years, Tamara Bates, founder of the fellowship the dots between, has worked with hundreds of artists in the Southwest and across the country. Her articles share information on the core topics she has been asked about and what she learned as a financial advisor. The images in this series are all from previous dots between fellows.

This is the tenth and final article in a series exploring financial topics pertinent to artists at different career stages. The columns in this series include:

- What You Need to Know as an Emerging Artist

- What Mid-Career Artists Need to Plan For

- What Late-Career Artists Need to Consider

- Basics of Managing Uneven Income

- Protective Factors for Managing Uneven Income

- Aligning Revenue, Time, and Values

- Student Loan Updates

- IRAs Explained

- 401(k) and 403(b) Employer Retirement Plans

- Sandwich Generation Financial Planning and Family Needs

Sandwich Generation Financial Planning for Family

One area where I see people getting into financial difficulty is when they assist family members in financial matters, which can create hardship for their budgetary situation. These types of issues are often called sandwich generation problems.

This article will explore resources that may be able to help you navigate the financial needs of family members while remembering to take care of your financial self, too.

The Sandwich Generation

The sandwich generation is effectively “sandwiched” between the obligation to care for their aging parents—who may be ill or in need of financial support—and children, who require financial, physical, and emotional support.

Make sure you are saving for yourself in these situations. If possible, don’t sacrifice your future financial health to spend money on a child’s education or for parents who may have not saved enough for themselves.

I am not advocating to shun those nearest and dearest to us financially. On the contrary, I’ll suggest the following resources and pathways for finding support.

Financial Planning for Your Children

Parents often ask me about 529 college savings accounts or other types of investment accounts for minors. The latter includes UTMA/UGMA accounts that can hold many types of assets, including stocks and bonds.

Funding in 529 accounts can be used for a wide range of college expenses at accredited schools (culinary, beauty, and trade schools, for instance) in addition to tuition expenses for private K-12 schools, certain apprenticeship costs, and student loan repayments. These accounts can also be transferred to other family members if the account beneficiary decides against attending school or doesn’t need the money.

My recommendation for setting up accounts for minors is to do this only after you have set up and maxed out the contribution to your retirement plan.

One tip I like to give parents is that they can plan to provide their child/children the parents’ Roth IRA money if it turns out the parent doesn’t need it for themselves in older age. The Roth IRA is one of the best vehicles for passing money from one generation to the next and will continue to grow tax-free, with distributions also avoiding taxes. This is also a way that I see grandparents helping their grandchildren.

For college, look for any type of eligible scholarship for your child. The national website Going Merry is a good starting place. In New Mexico, the Albuquerque Community Foundation and Santa Fe Community Foundation list multiple scholarship options.

I bring up this suggestion for you no matter what state you live in—look at your local community foundation’s website for education support and other types of resources. This is often the best place to find multiple resources in your community that could benefit you.

And while student loan debt is not something we wish to burden our children with, it is an option.

Financial Planning for Your Elders

It’s important to know if your parents have health directives and medical power of attorney. If they have these documents and you are the medical POA, make sure you know where the documents are located and/or have a copy of them. Talk to your parents about their burial wishes and if they have made any arrangements. I know I am suggesting something that may be difficult—this article provides a good overview of how to have these types of conversations and includes links to several estate planning guides.

If you are providing financial support for elder family members, make sure that it won’t interfere with their ability to qualify for government programs. For example, if you move money directly into your family member’s bank account, it may count as their income and disqualify them from receiving assistance. Here is a good place to search for care programs across the country, and here’s another helpful list for finding multiple resources.

The Bottom Line

Avoid extracting money from your retirement accounts or taking loans from your 401(k) to cover family emergencies. Even withdrawing a few thousand dollars now can lead to a loss of tens of thousands of dollars in future earnings and interest. Try to find programs to support your family so you can keep on track with your plans.

I have enjoyed writing this series for Southwest Contemporary and I hope you have found it beneficial. This is my last article for now, but before I go, I’ll leave you with a list of artist residencies for parents.

Art Residencies for Artist-Parents

Sustainable Arts Foundation

Motherhood in the Arts: The Residencies Supporting Parents